The current tax year will end on 5th April 2021, therefore now is the time to look at opportunities to reduce your personal/corporate tax liability for the current year.

There were no announcements in this month’s budget (March 2021) that will take effect within the current tax year.

Now is the time to think about:

- Could you save or delay tax by moving income and expenditure between accounting periods? The Chancellor announced a new “super deduction” for expenditure on plant and machinery from 1 April 2021. This means tax relief of 130% of expenditure can be claimed.

- Do you provide your personal services through your own company? The way you are taxed may change from 6th April 2021 due to the off-payroll working rules.

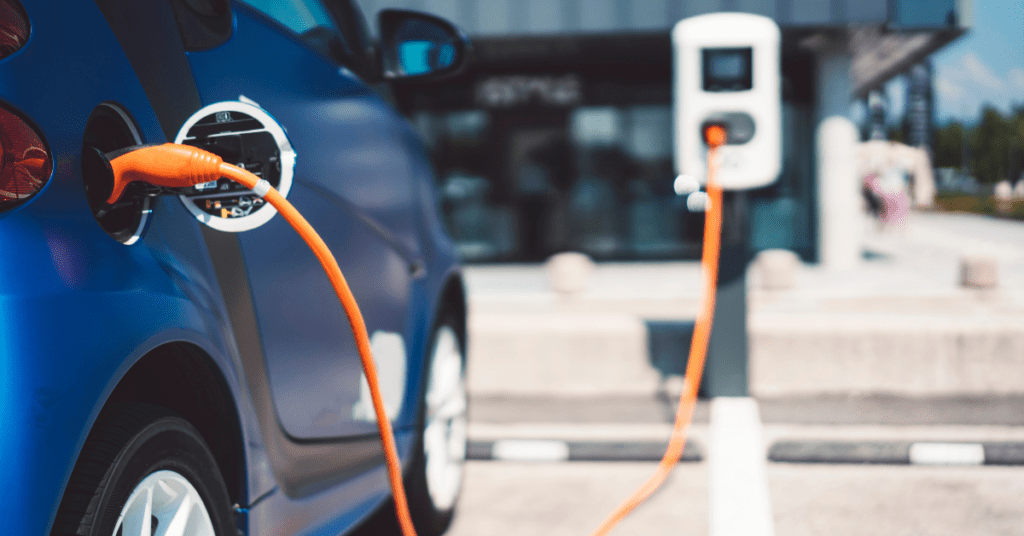

- Have you considered changing your company car to an electric one? The taxable benefit from 6 April 2021 is only 1%. Also, when your company buys a new electric car (before 1 April 2025) it can claim 100% of the cost as a capital allowance in the year of purchase.

- Do you pay the High-Income Child Benefit Charge? You may be able to reduce your taxable income to avoid this.

- Brexit – if you import or export goods you may need some additional paperwork now that the UK has left the EU. If you have not already done so, you need to apply for an Economic Operator Registration and Identification (EORI) number.

- If you think the value of your estate may exceed the current Nil Rate Band of £325,000, we recommend an Inheritance Tax Review to ascertain what liability your estate may have and what can be done now to mitigate this. It may be possible to remove or significantly reduce potential IHT with early planning.

- Pension payments – are you a higher rate taxpayer? Making contributions extends the basic rate tax band, which extends the point at which you pay tax at 40%. If you have not maximised your contributions over the current and/or past 3 tax years, there is an opportunity to utilise any unused allowances in the current tax year.

- Do you own residential property? A range of new rules affecting income tax relief, capital gains tax and stamp duty land tax mean a review of your current property portfolio is recommended. It may be better to incorporate to mitigate tax liabilities.